Under The Microscope - Aave

JP Morgan Chase, Goldman Sachs, Morgan Stanley, Deutsche Bank, HSBC - these household TradFi names all make the list as being Global Systemically Important Banks (G-SIB). With trillions of dollars of deposits and investments across the globe, these titans of finance underpin the TradFi system, providing the liquidity that drives the global economy and keeps the market moving. When these institutions cough, the market takes notice.

With over $39bn in TVL Aave has emerged as DeFi's most systemically important lender, providing the credit the on-chain market needs to keep capital efficient and operate smoothly. Directly or indirectly, Aave has become deeply integrated across the whole DeFi ecosystem and is continuing to branch out, with a recent deployment on Aptos establishing a presence beyond the EVM. Just like the G-SIBs in TradFi, Aave generates meaningful signals which the whole market should be paying attention to.

Using Pangea's new SQL and AI Framework, we deep dive into the data on Aave, with a particular focus on understanding who is using the protocol on Ethereum and Base. Our findings show strong growth trends, with increasing users, improved retention, and more whales making increasingly large borrows.

Growth

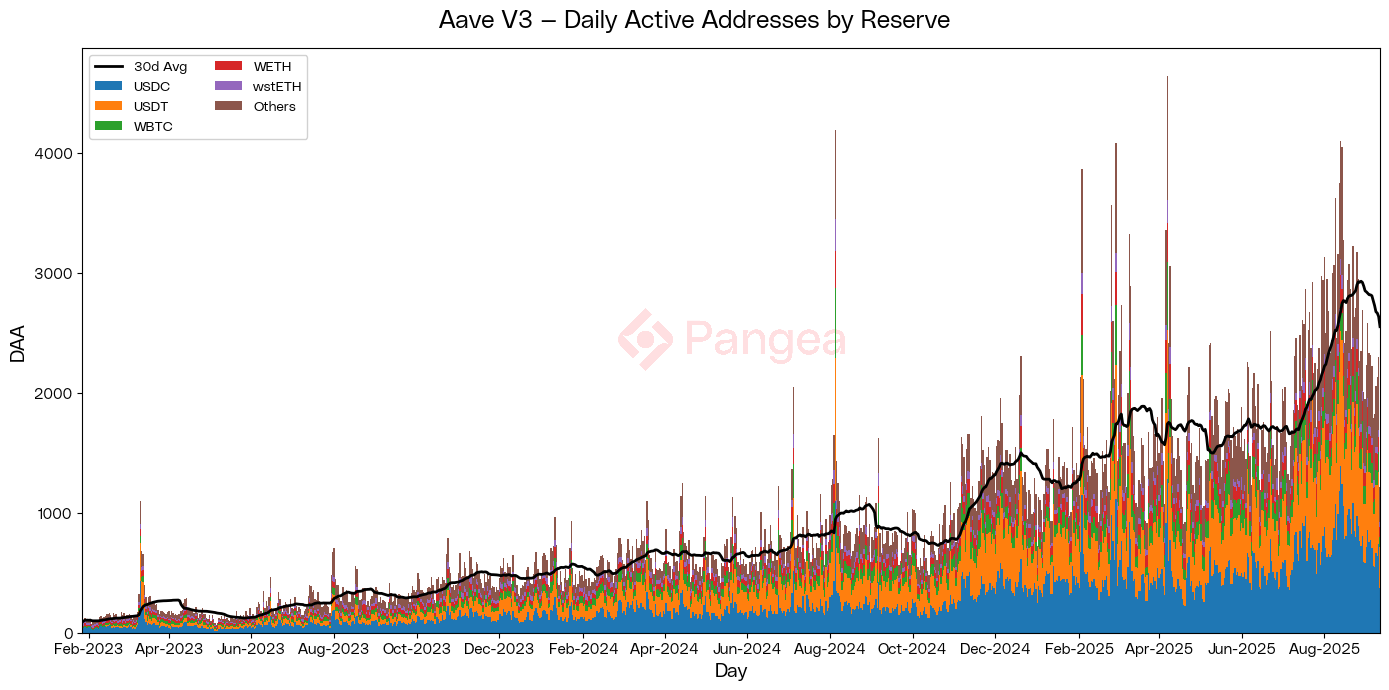

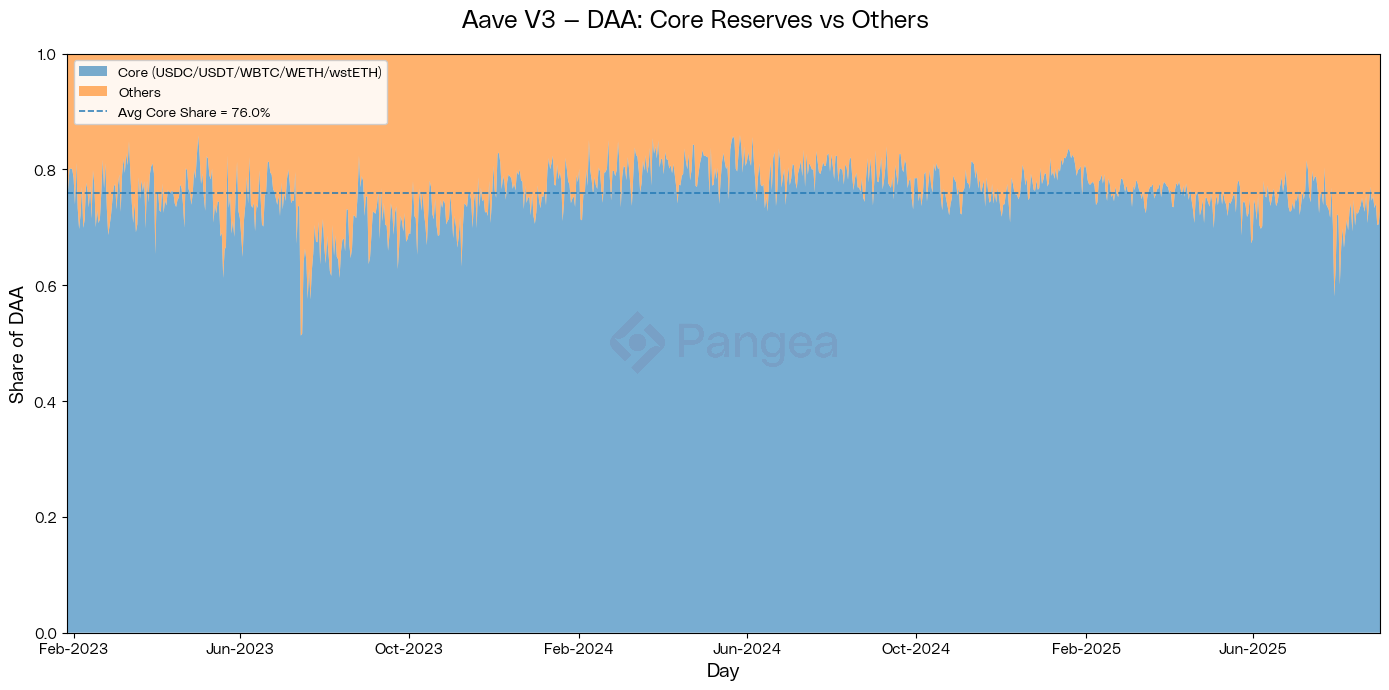

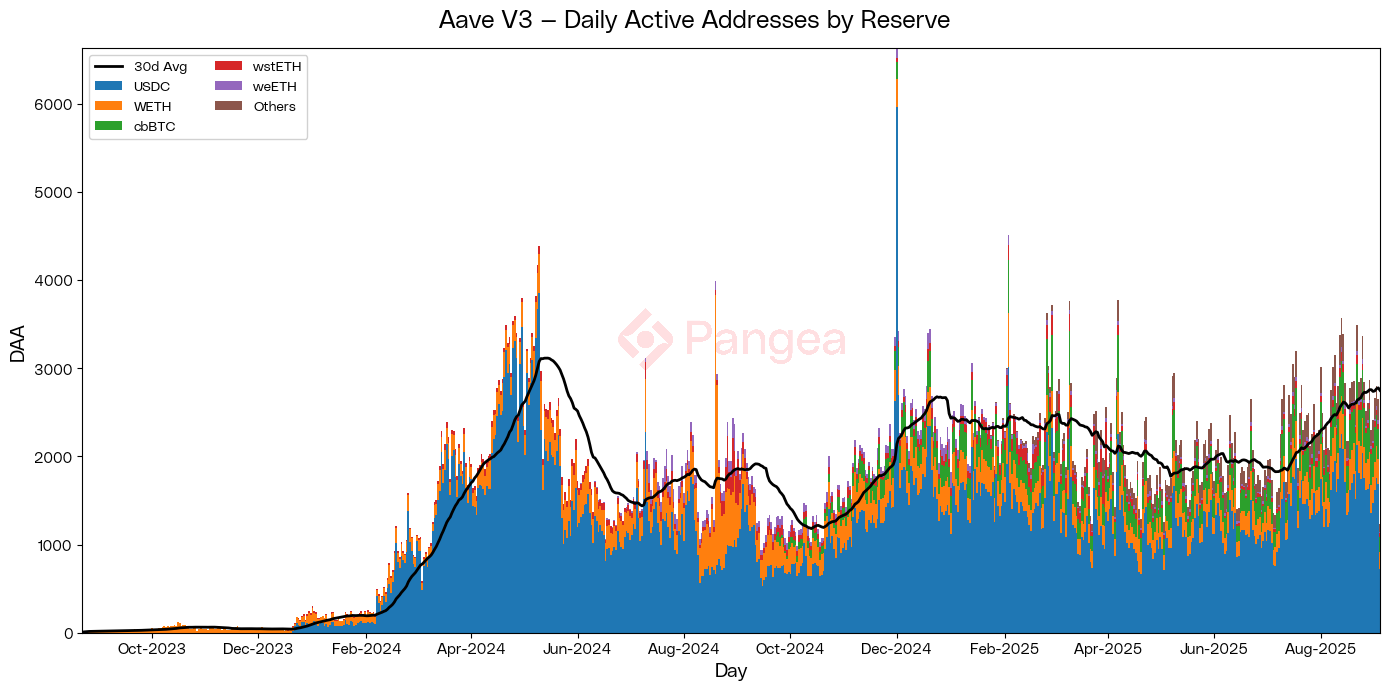

Aave has seen fantastic growth since the launch of its V3 markets, with over 2500 addresses transacting through its contracts every day on Ethereum alone, an increase of 194% over the past year. Although over 50 assets are supported, the top 5 markets (USDC, USDT, WBTC, WETH, wstETH) account for an average of 76% of users activity.

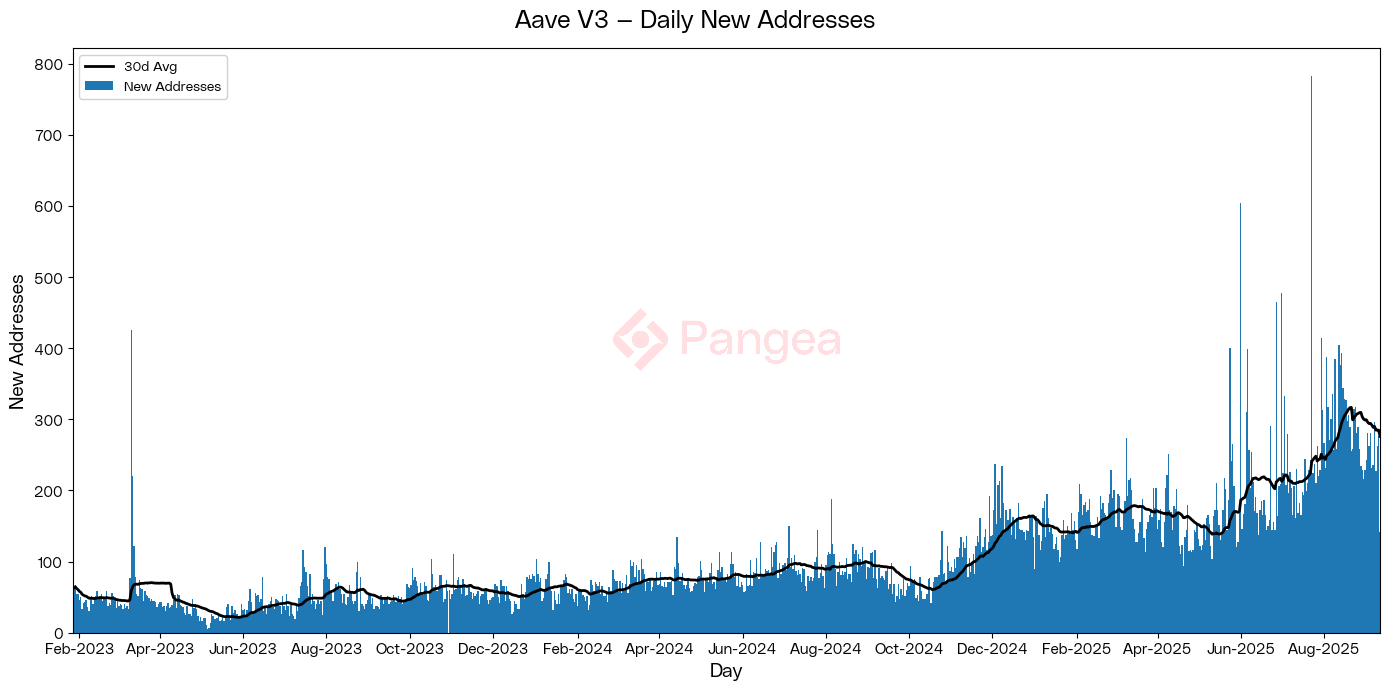

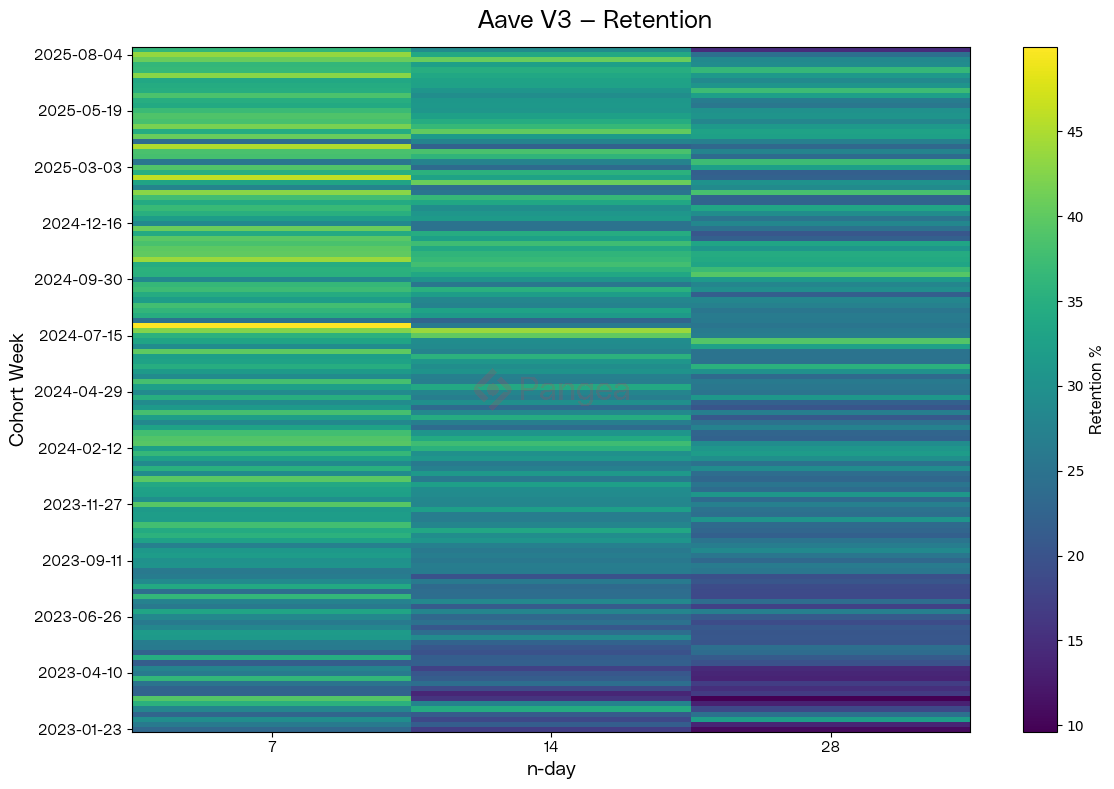

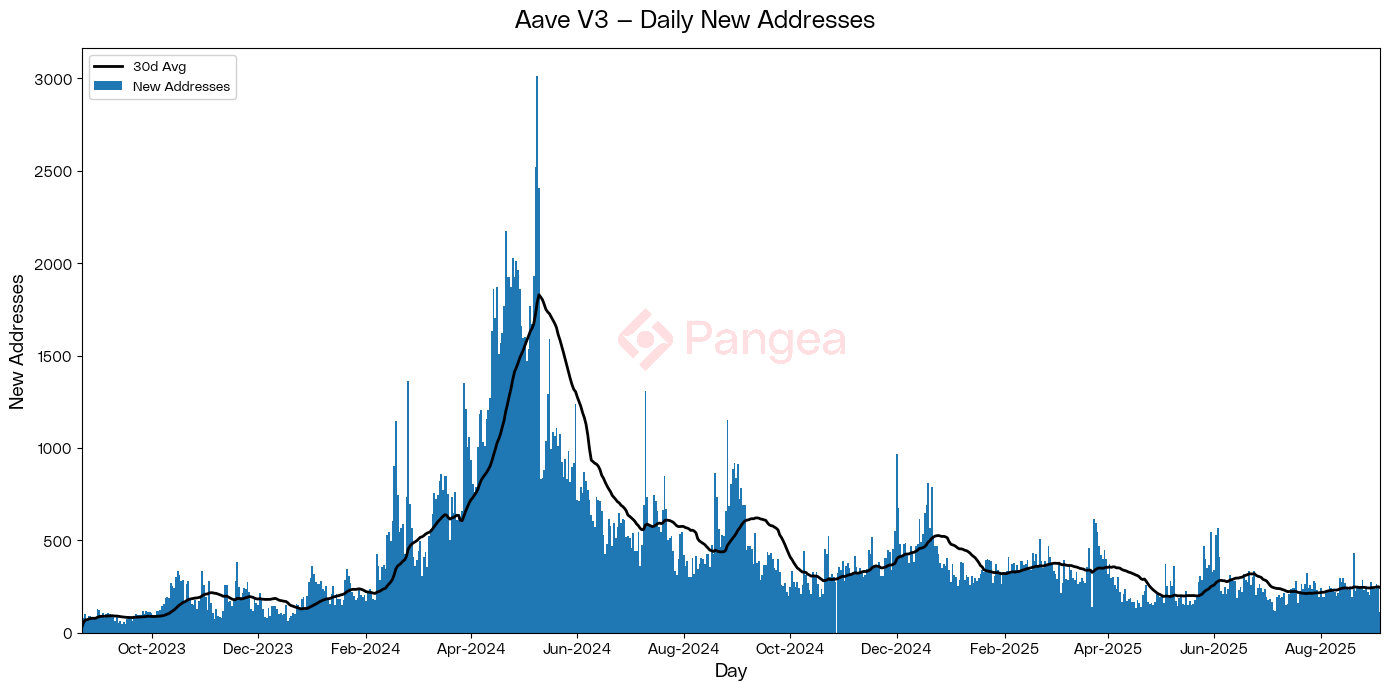

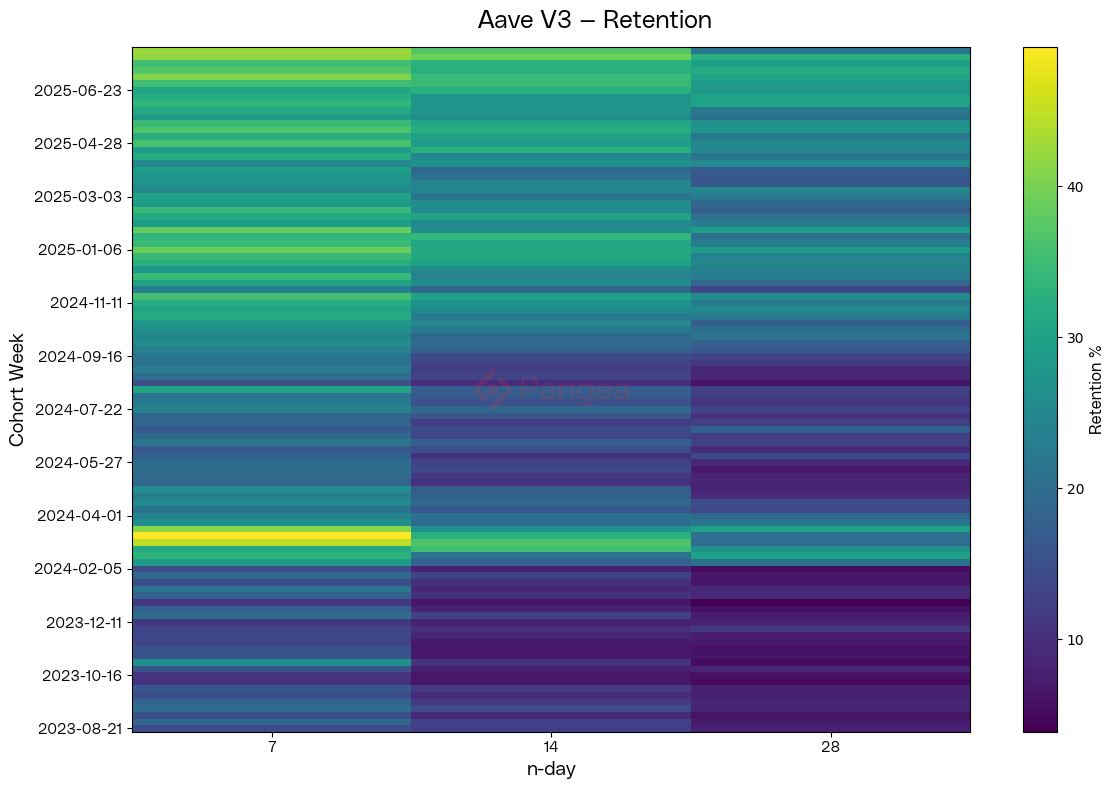

Aave's rise in daily active addresses is driven not only by an increase in activity from existing users, but also by a 196% annual increase in daily new addresses. When these new users try Aave they are increasingly tending to stick around, with improvements in weekly (9.92%), fortnightly (9.95%), and monthly (10.78%) retention rates over the past year.

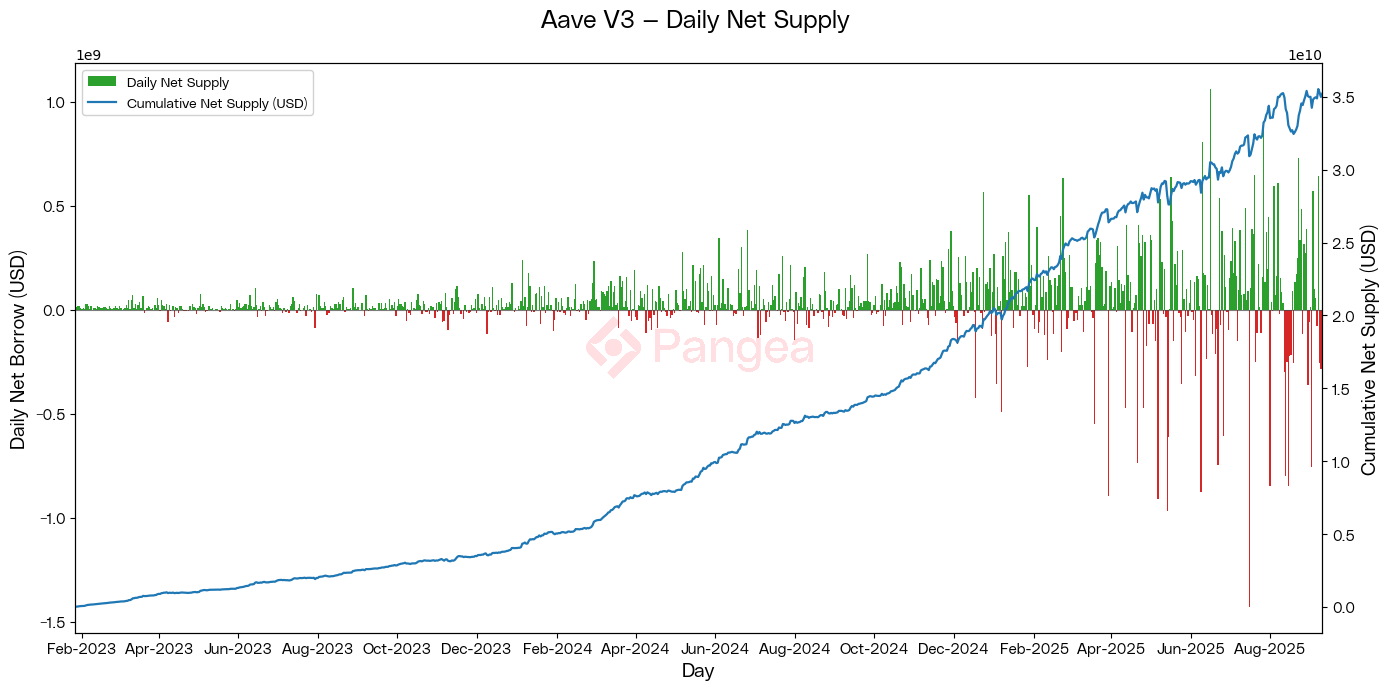

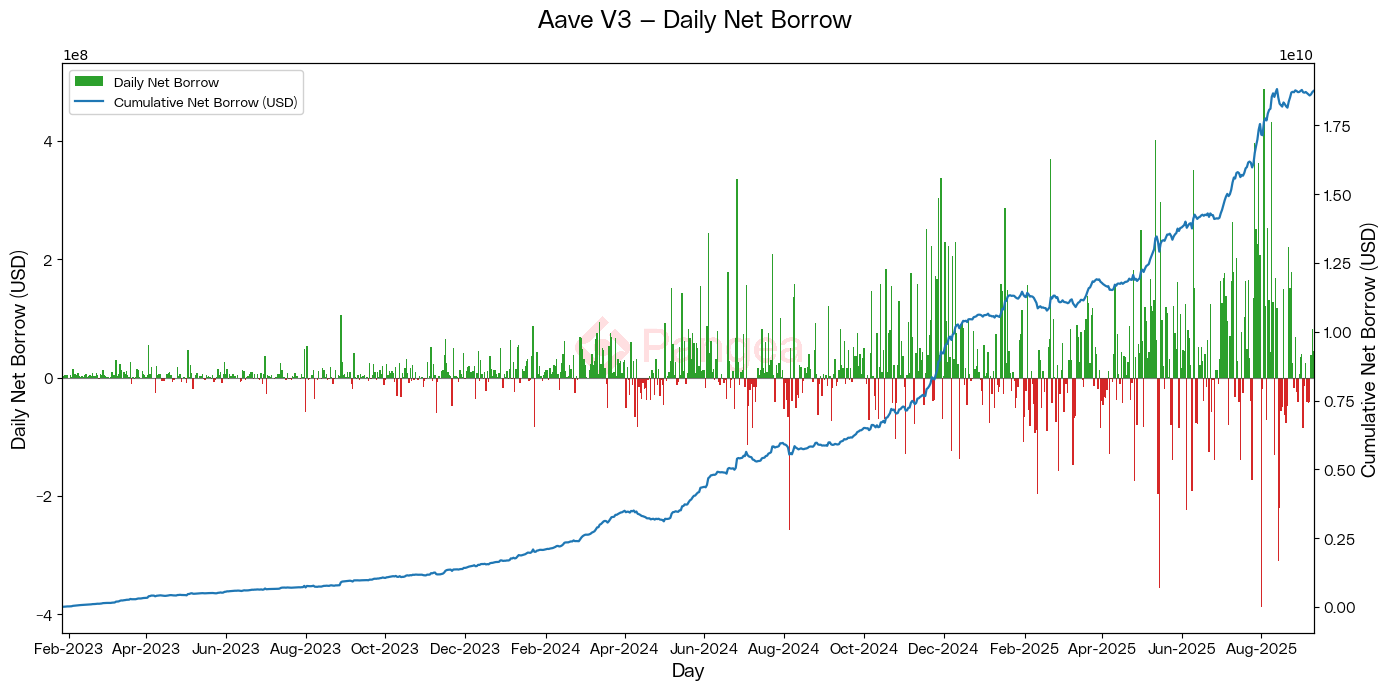

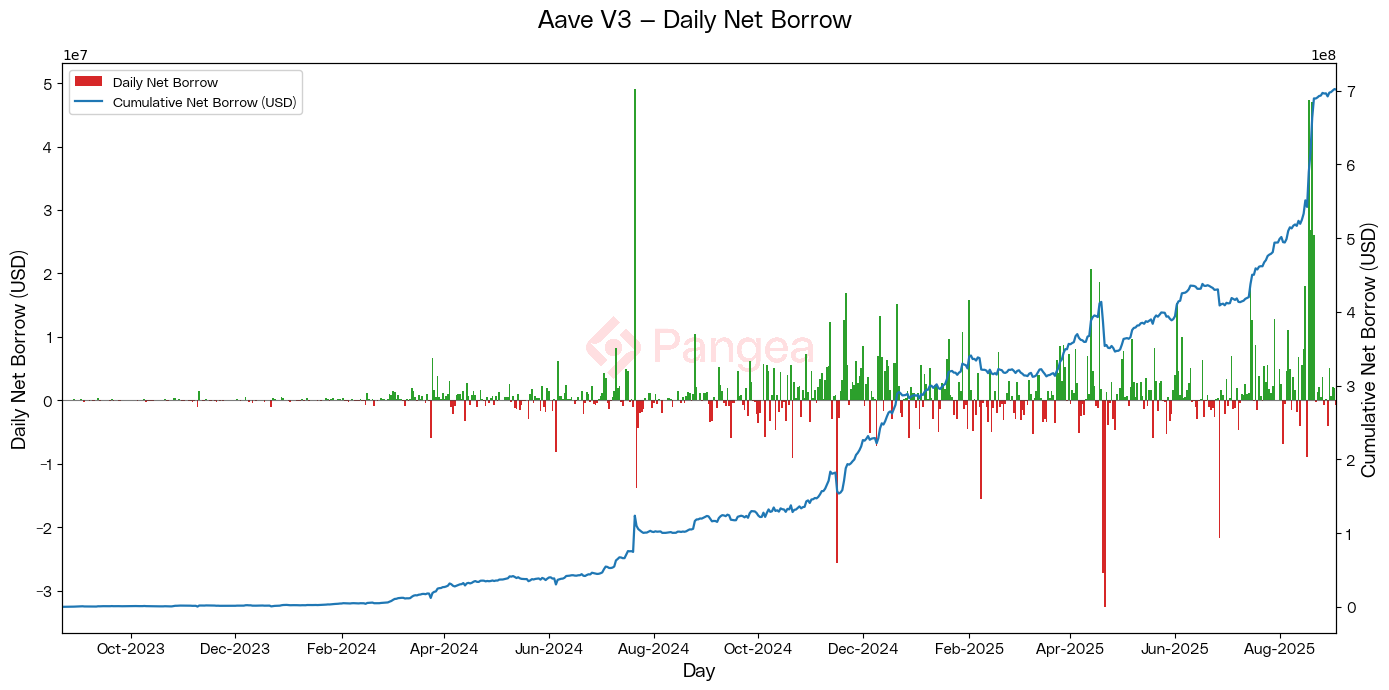

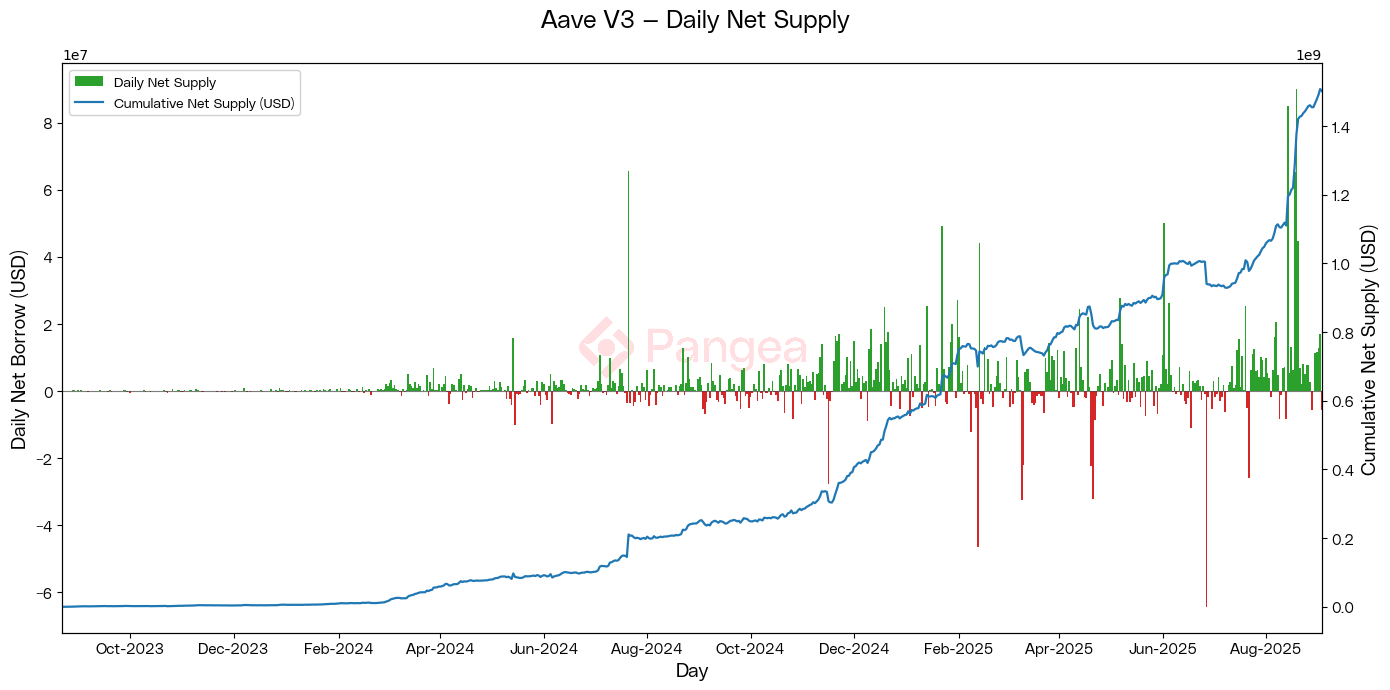

As we'll show in more detail, what really moves the needle for Aave is not necessarily user numbers but overall volumes, and here we also see strong growth. The amount of liquidity supplied on Aave V3 has been steadily increasing, reaching over $35bn. This deep liquidity is facilitating increasingly large daily net borrowing, which has recently been in excess of $400m. Aave's ability to accommodate huge size is attracting Ethereum's largest whales and these are the users which are making a difference.

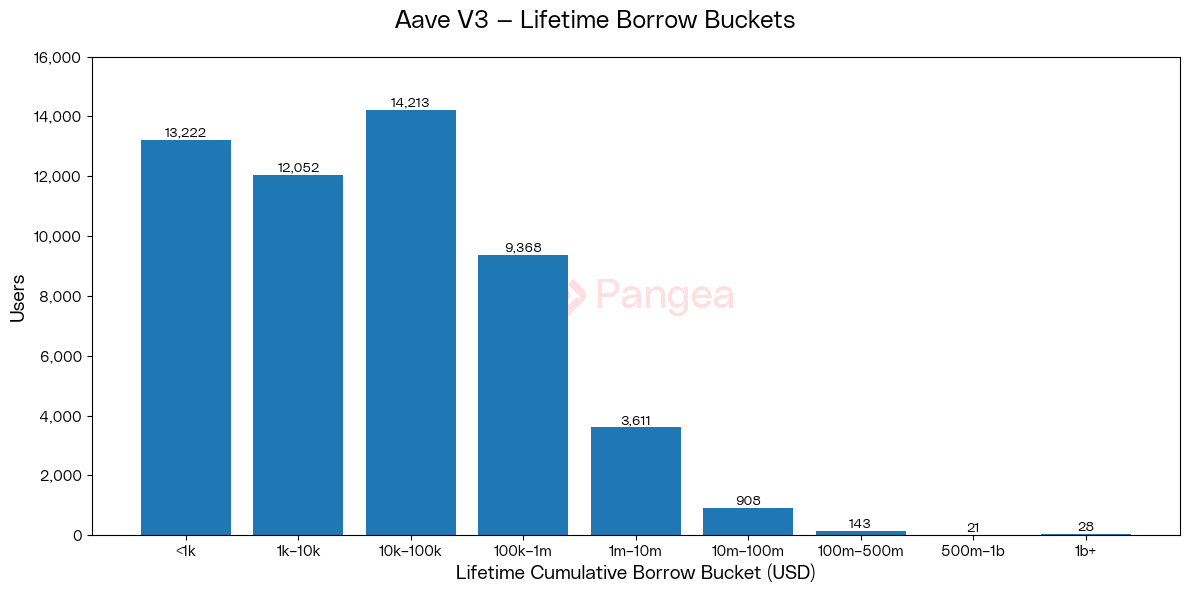

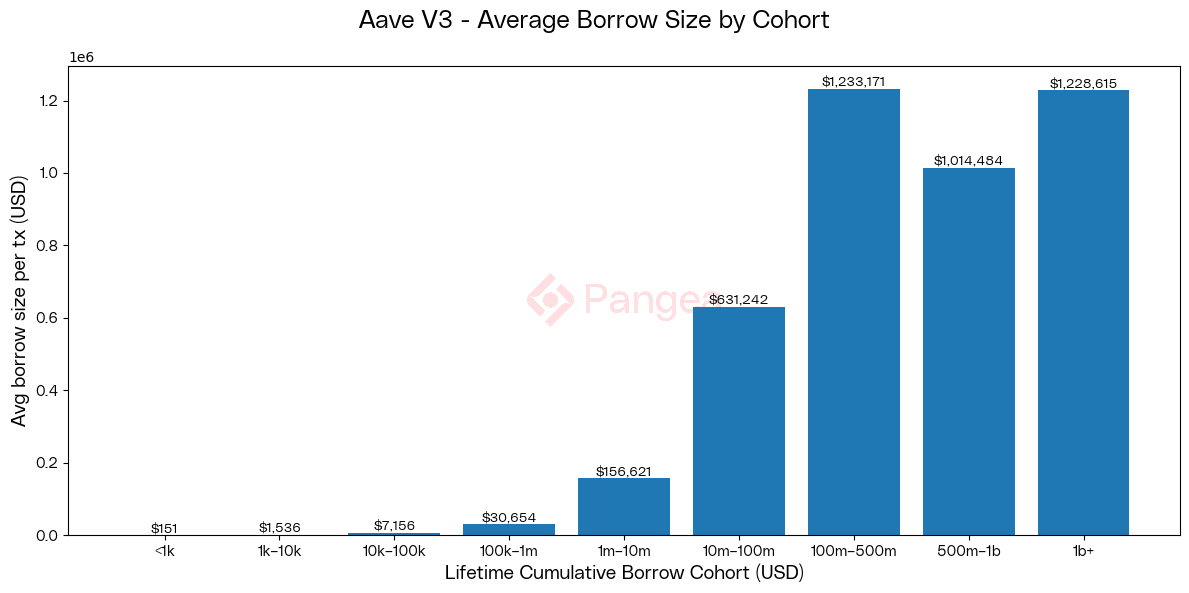

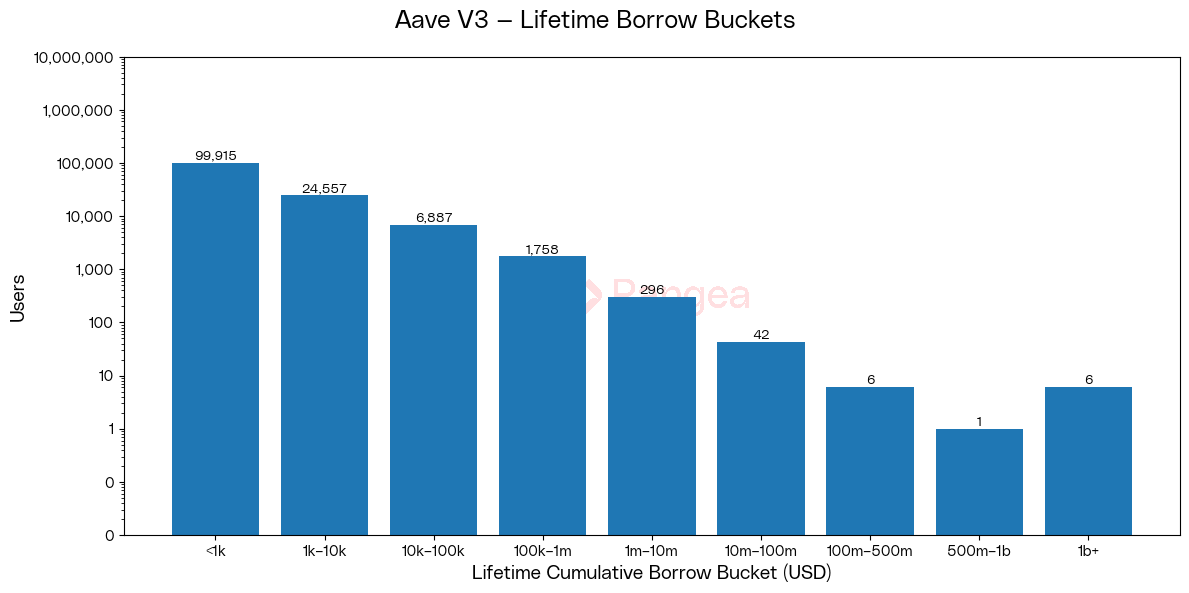

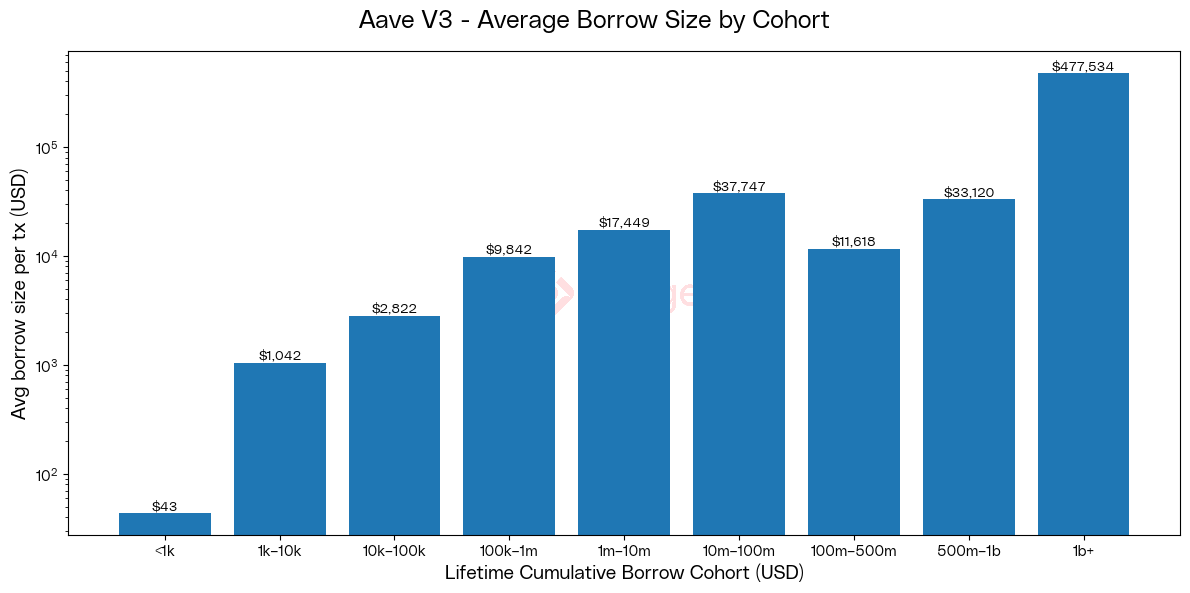

We wanted to understand more about Aave's user groups, so we bucketed addresses by their cumulative lifetime borrows. We find the bulk of users in the intermediate $10-100k range, yet their average borrow amounts are negligible compared those from the relatively small number of >$100m whales, who regularly borrow over $1m per transaction. This small cohort of whales account for an outsized portion of Aave's flows.

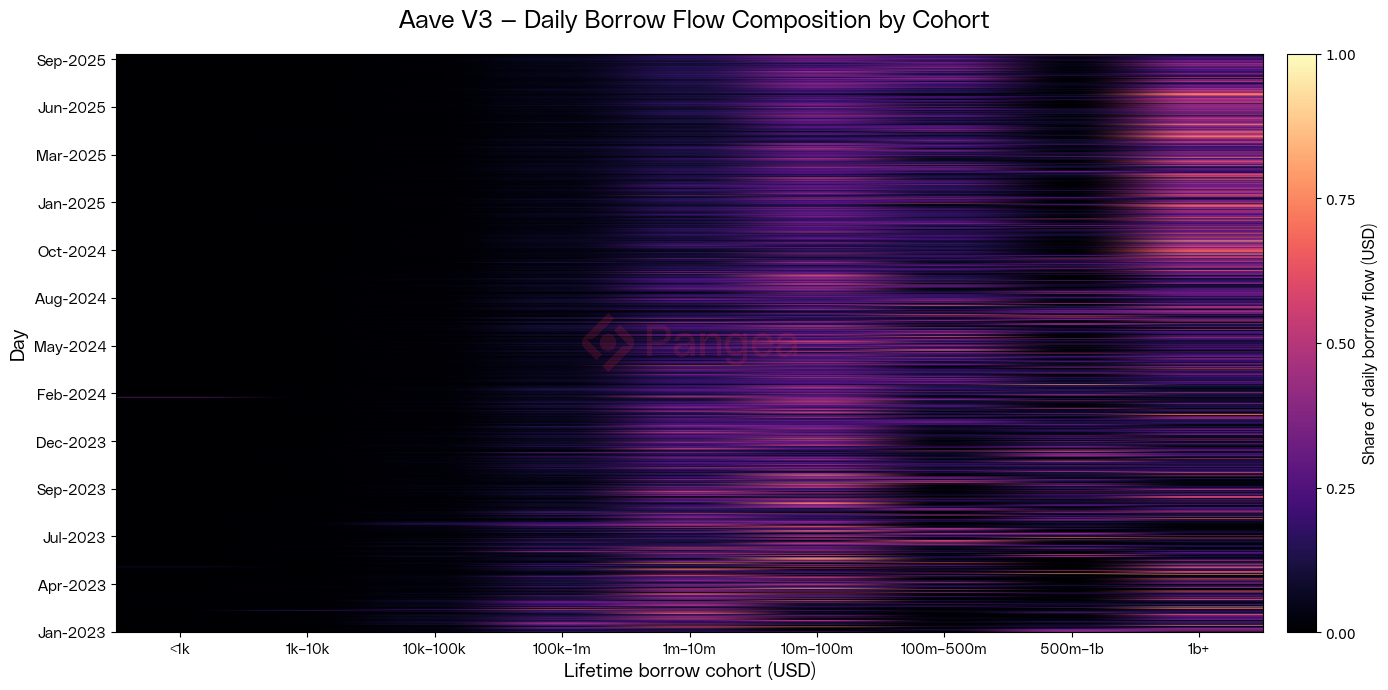

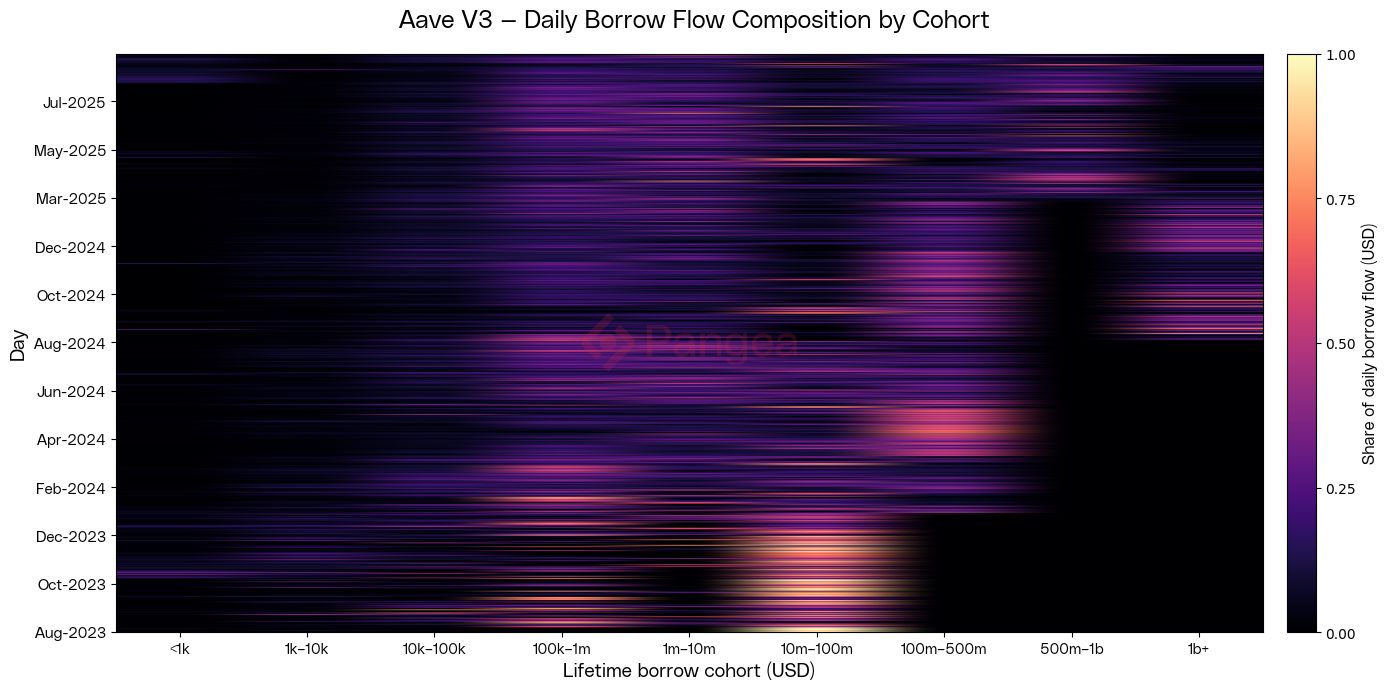

The next chart shows each cohort's contribution to the daily borrowing flow, with lighter spots indicating a greater share of the day's total borrowing. We can see that the $10-100m cohort is the bread and butter of Aave's everyday volume, providing consistent flows almost every day since the launch of V3. However, we also see an emerging trend as the concentration of daily borrowing increasingly shifts to larger wallets, especially the >$1bn cohort who have been dominating on most days since Oct-2024. Whilst these concentrations do present some risks, it tells an encouraging story of adoption. Aave's maturity, trust, and depth of market is scaling to support institutional size. Retaining and growing these whales will be key to the next phase of Aave's growth.

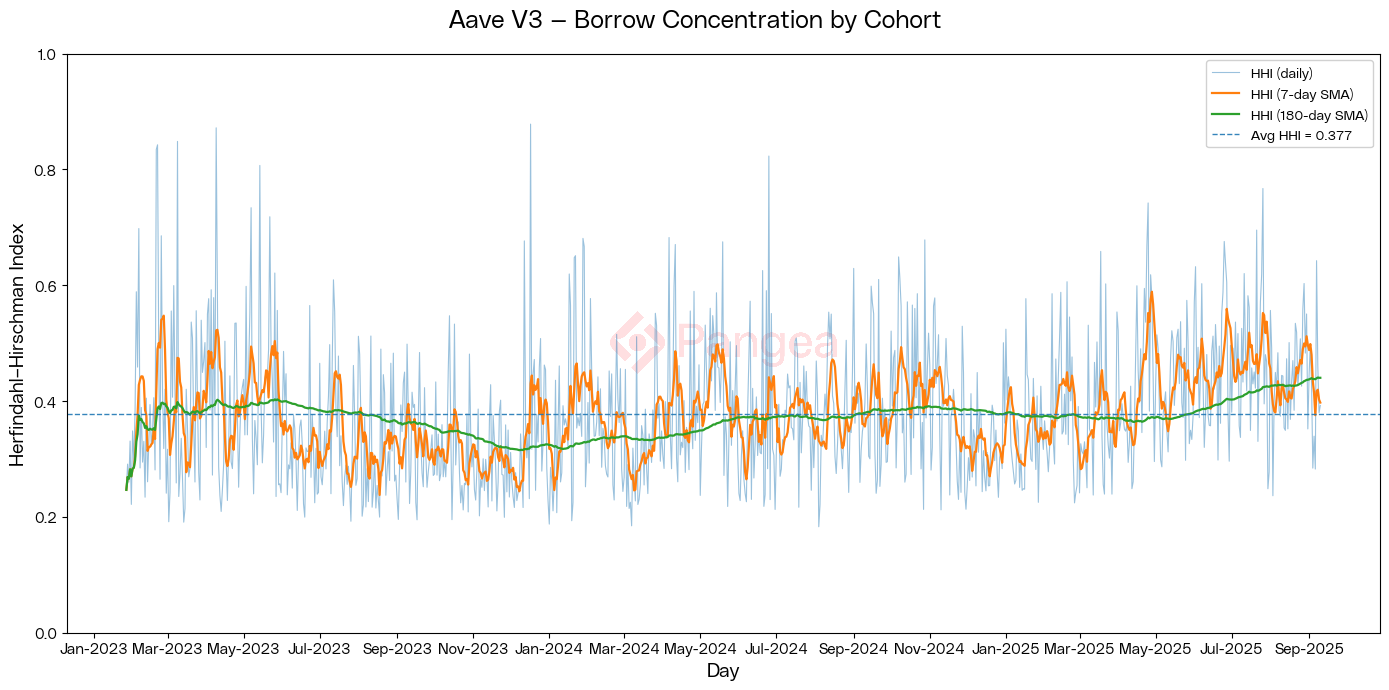

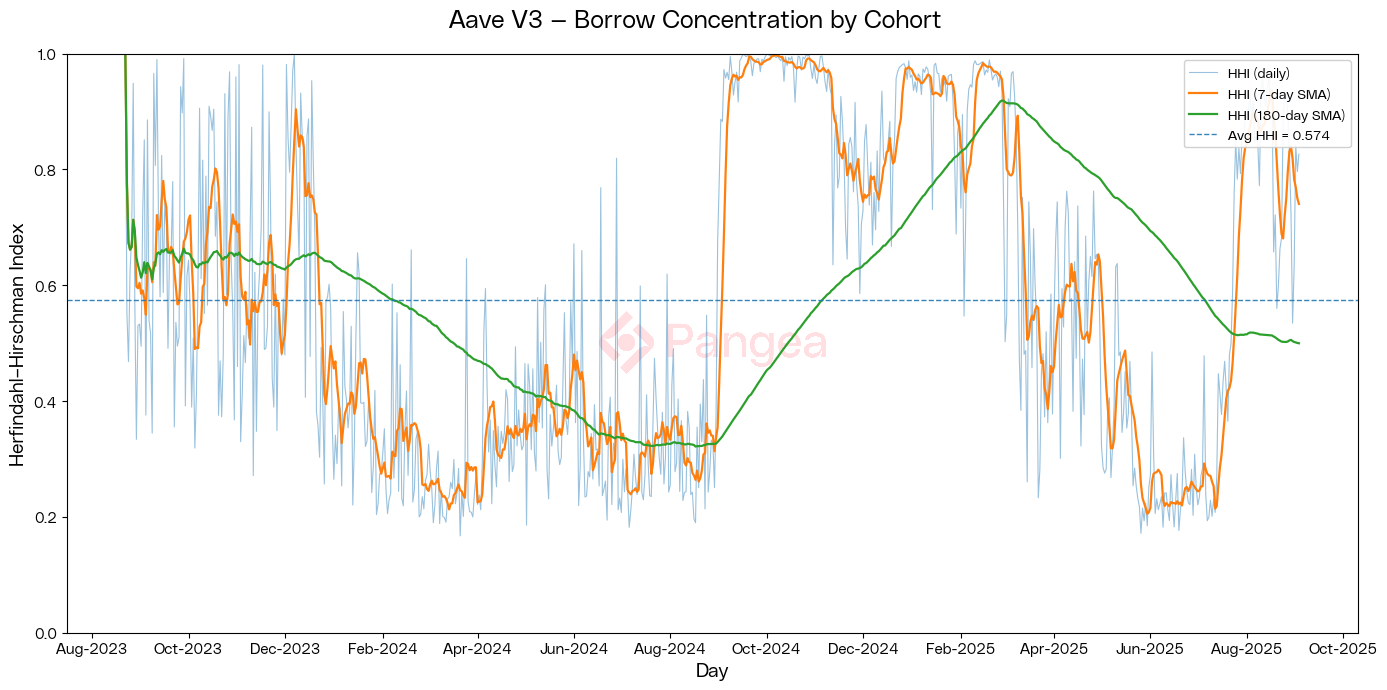

The Herfindahl-Hirschman Index is a measure of concentration in markets, with a higher score indicating daily borrow flows concentrated among fewer effective cohorts. On the average day ~2–3 effective cohorts drive a typical day’s gross borrows. Frequent short spikes to 0.6-0.9 indicate 'whale days' where one cohort owns the majority of the day’s borrowing. Our 180d moving average indicates that the concentration of borrowing activity has been increasing, which aligns with the result of our flow analysis above. A handful of whale addresses are having an increasingly outsized impact - these are the wallets that are really moving the needle for Aave. Whilst this concentration poses the risk that a few addresses stepping back could significantly impact flows, it also shows that Aave has succeeded in created a sticky product that keeps these whales coming back.

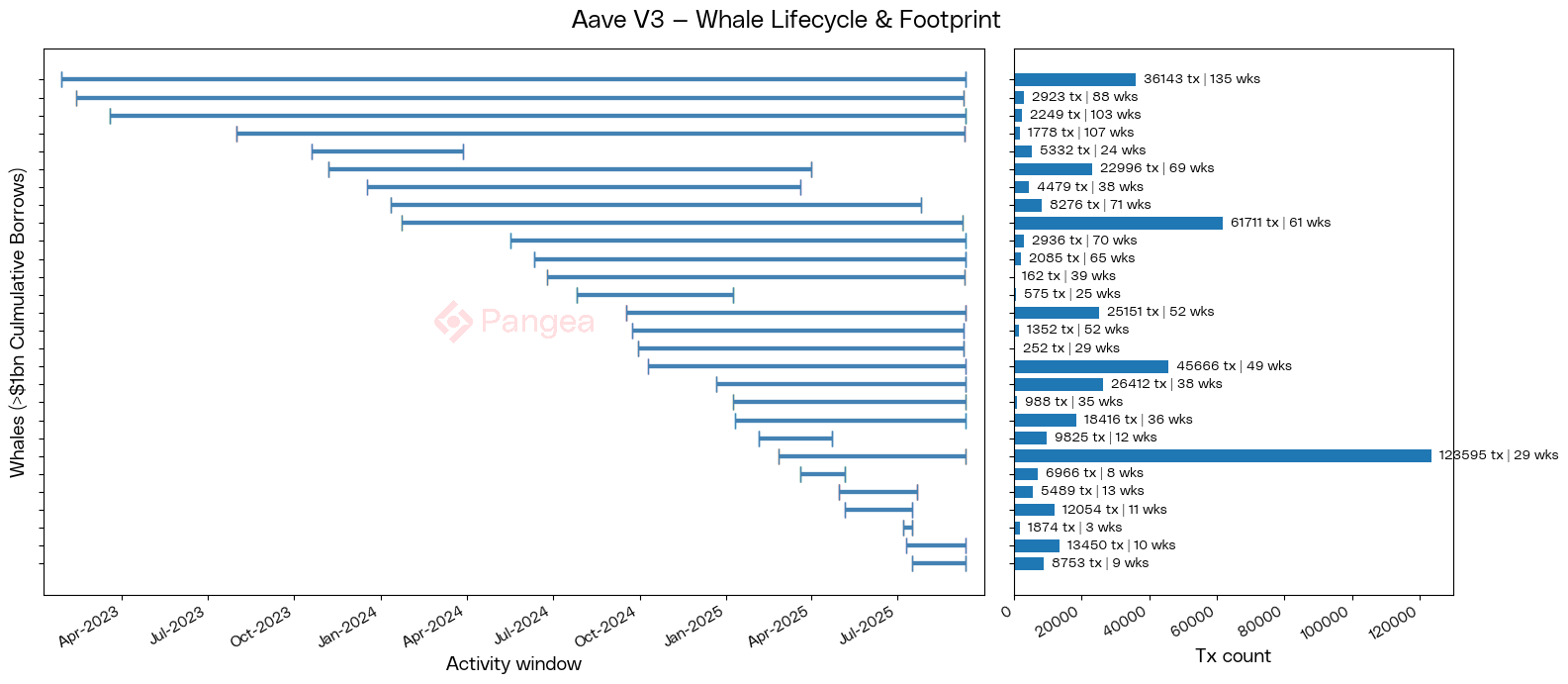

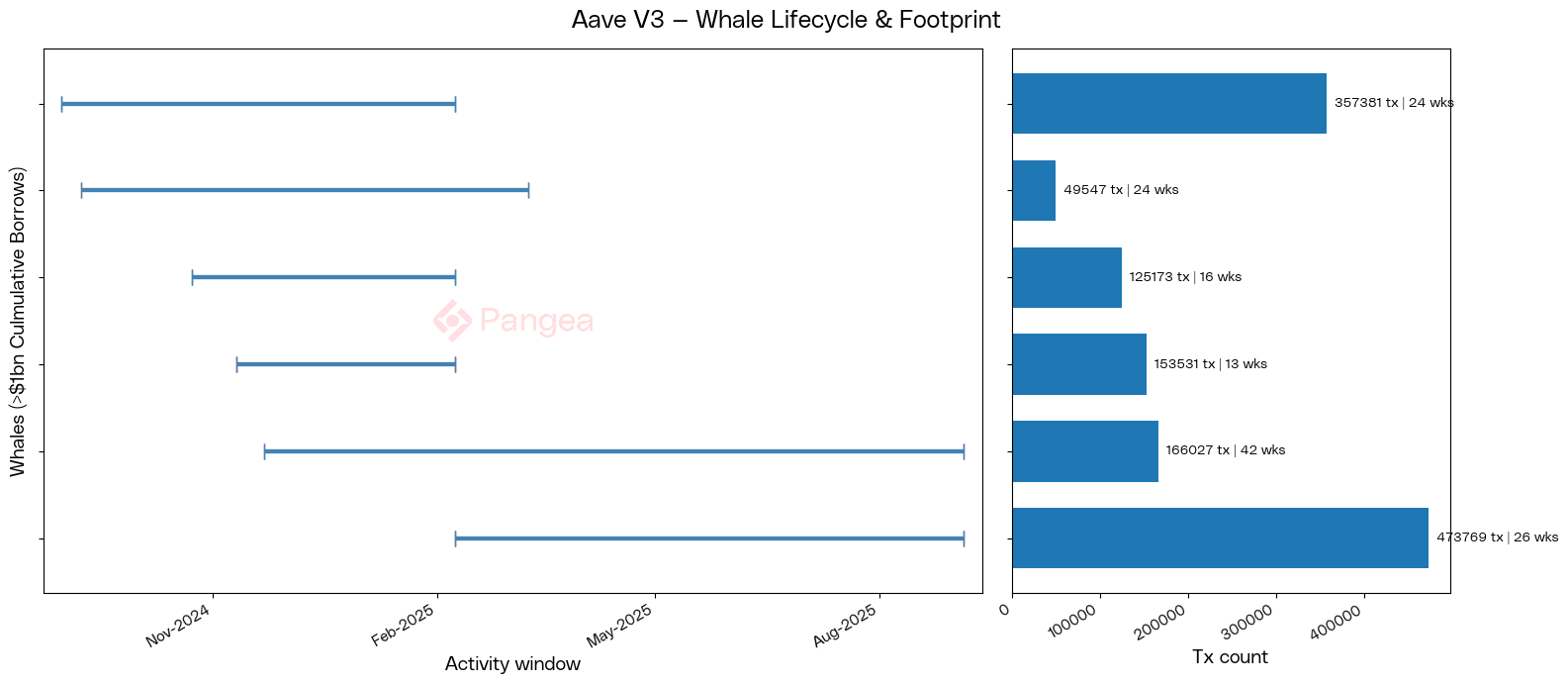

We looked at the lifecycle and footprint of Aave's 28 largest whales, all with cumulative borrows in excess of $1bn. 16 new whales joined in the past year, up 78% from the 9 who joined in the previous year - this is the user growth which is making a difference for Aave's volume. In terms of retention, 10 whales have not transacted in the past 28 days; we can't be sure that they have all left for good, but every leaver at this size has a big impact. Nonetheless, 64% retention for wallets of this size is very respectable, showing that when whales start to use Aave, they tend to stay. There's a broad distribution of transaction frequency among this group; some are more passive, high time-frame traders, whilst others - including one account averaging 609 transactions per day - appear to be actively market making with automation.

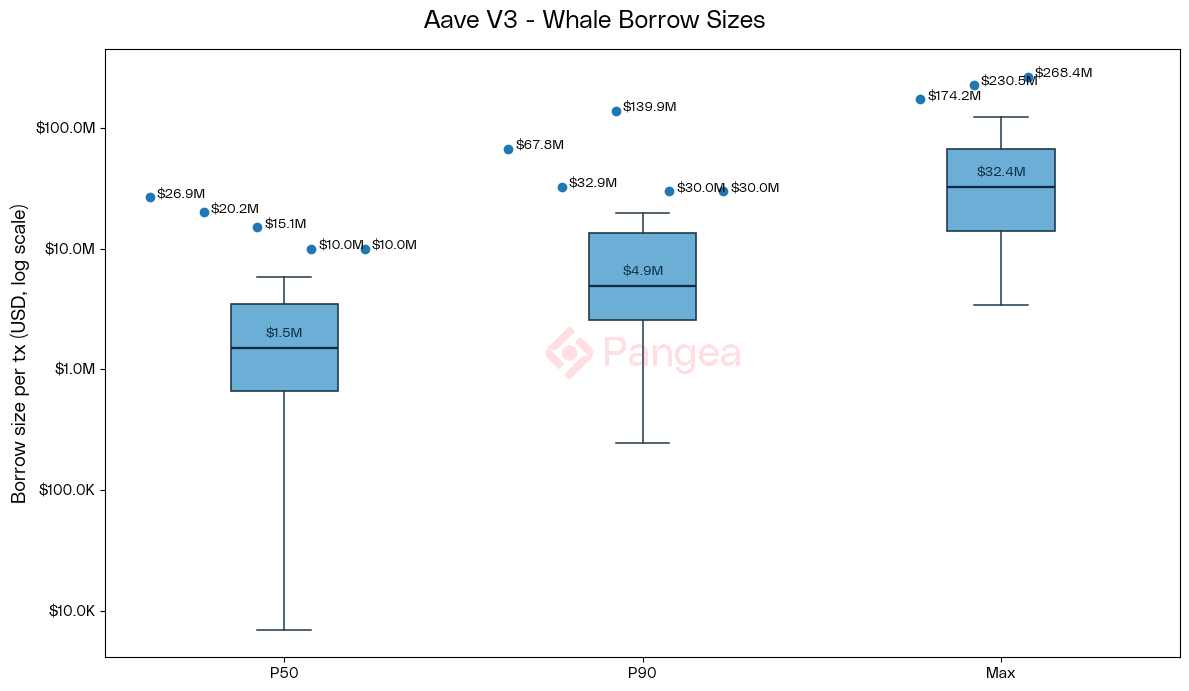

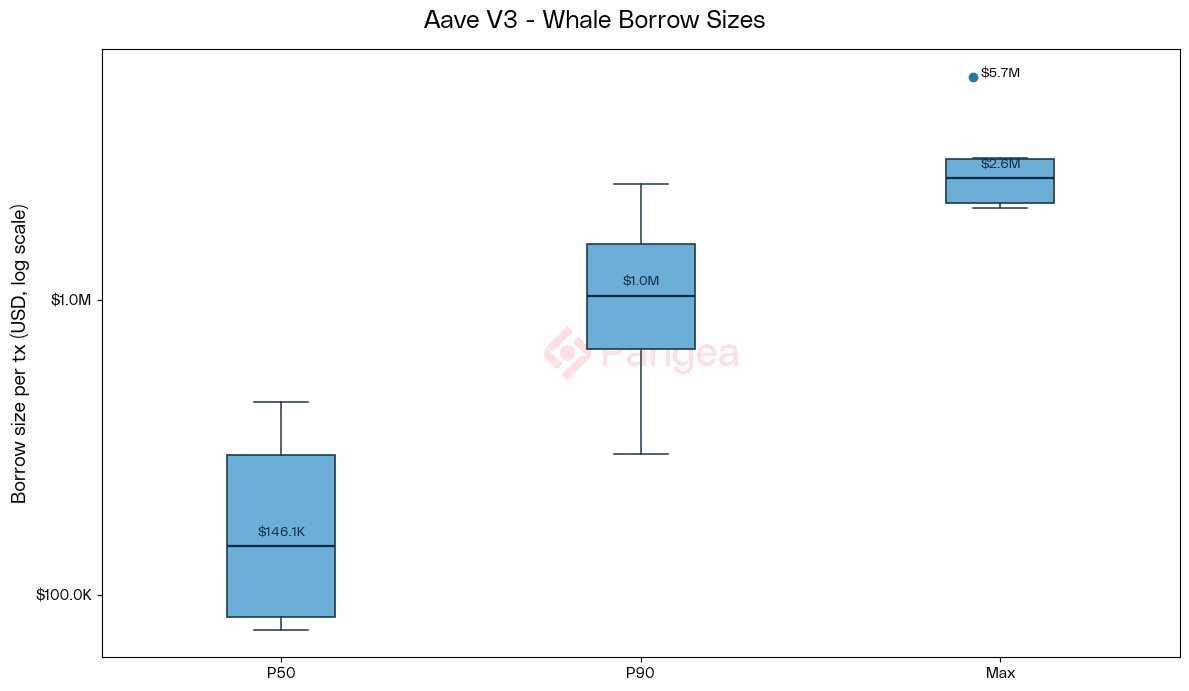

These whales tend to borrow >$1.5m per transaction, with many seven figure borrows. However we do also see relatively small borrows as low as $10k, which may be further evidence of bot activity. The largest single borrow tops out at $268.4m - this is permissionless, no-KYC, decentralised finance at it's finest.

Base

Base has been picking up steam as a preferred EVM L2, offering fast and cheap transactions with easy access through its integration with Coinbase. We wanted to compare metrics against Ethereum to get a sense of how L2 users might differ and understand how much appetite for borrowing there is on Base.

Active address numbers haven't shown the same exponential growth trend, with annual growth currently sitting at a more modest 48%. After an initial burst of usage in Q2 2024 activity has remained fairly constant in the 2-3k range, similar to Ethereum. As might be expected given the Coinbase x Circle partnership, we see USDC taking up an absolute majority of activity with USDT entirely absent.

Looking at new addresses further validates the picture, with growth declining by -59% following the initial post-launch hype. Although new users are in decline, user retention tells a more positive story, with weekly (48.33%), fortnightly (83.77%) and monthly (93.48%) retention rates all showing very strong growth. It seems that after an initial surge of non-committal users Aave is beginning to find its audience on Base.

To put into perspective the size that Aave handles on mainnet, culmulative net borrows across all markets on Base are seven times smaller than mainnet borrowing for USDC alone. Nonetheless, lending and borrowing activity is far from anemic, following a similar growth trend to mainnet that has been especially lively in the past month despite there being no significant increase in users during this period. Multiple datapoints corroborate that this recent uptick in volume on Base is driven by a handful whales with deep pockets, rather than the onboarding of a multitude of small accounts.

Bucketing user groups reveals a distribution which is similar in shape to Ethereum but even more extreme (so much so that we had to show these charts in log scale). A handful of whales in the >$1bn lifetime borrow bucket are borrowing orders of magnitude more than any other group, whilst on the other end of the scale vast legions of shrimp are borrowing negligible amounts.

On Base we see a familiar trend of flows increasingly becoming dominated by larger wallets. The ~100k addresses in the lowest bucket contribute a negligible amount to overall flows, whilst the middle-size $100k-1m and $1m-10m cohorts are the backbone of everyday borrowing. With much lower overall volumes it doesn't take as much to move the needle, but the charts show that flows on Base are now often led by the whale cohorts.

The HHI index shows that it's not unusual for a single cohort to completely dominate borrowing flows for extended periods. This high level of concentration means that borrowing volume on Base is rather binary - either the whales are active, or they are not. We also note that whilst between Aug-2024 and Mar-2025 the six wallets in the >$1bn cohort were dominant, this activity has completely dropped off in recent months.

Diving deeper into the activity of these addresses shows that four of the six whales in this important cohort have not been retained. The two remaining accounts are almost certainly bots, with the latest joiner being responsible an average of 2,603 transactions per day.

Base doesn't yet have the depth to support nine figure borrows, with the max topping out at just $5.2m. Whilst the average borrowing size of these whales is orders of magnitude smaller than on mainnet, the frequency of their transactions is also far higher. It's likely that Base's whale cohort is completely different in character to mainnet, as Base's lower gas costs and faster block times make it possible for bots to rack up significant volume over time.

Overall, the picture on Base tells a similar story of growth to mainnet, but on a smaller scale. What's really moving the needle for Aave here is not a sea of shrimp, but rather the onboarding and retention of whales. However, the behaviour of these Base whales is very different - these are not high-net-worth individuals, but successful bots. Understanding the activity of these higher-frequency traders will be key to growing and retaining this cohort, which will make all the difference for the success of Aave's Base deployment.

Conclusions

Aave has matured into a systemically important protocol underpinning the DeFi ecosystem and will surely be here for the long-term. Our deep dive into Aave's users shows strong growth, with activity exploding in recent months through increased users numbers, improved retention, and whales making increasingly large borrows.

With larger institutional wallets entering the scene the game is shifting for DeFi protocols, as capturing and retaining these whales - which make up an increasingly large portion of overall flows - becomes key to realising the next phase of growth. To capture these high-value clients, we might expect a shift in customer acquisition strategies towards a more personalised, white-glove treatment that has hitherto been foreign to the spirit of permissionless DeFi. Wining and dining IRL may well supplant posting memes on CT, as DeFi puts it's suit back on.

At the same time, shifting focus from a broad base of smaller retail users to a handful of larger clients brings its own risks. When a few exits can cause outsized impacts, liquidity becomes more fragile. In a mercenary market filled with short-term incentives, intangible qualities like having a trusted brand and a track-record of safety will be key differentiators to making deposits sticky.

Calling All Analysts

All of the analytics you see in this article were generated in the space of an afternoon using our new SQL and AI Framework. Pangea makes it easier than ever to go from 0 to 100 when accessing on-chain data - fetching logs, transforming into usable data, building aggregations, and plotting a clean outputs - our tools are enabling pros and amateurs alike. Unlike other platforms which require slow and expensive refreshes, Pangea streams in real-time, meaning that all of these metrics can be deployed as live dashboards. If you are interested in diving into your project's KPIs, building dashboards to show off your success, or exploring the chain with the power of AI, get in touch on our Discord.