What are Bitcoin Runes?

What are Bitcoin Runes? Let's explore the new protocol enhancing Bitcoin's ecosystem with efficient, scalable fungible tokens.

Let's unpack Bitcoin's latest development.

Understanding Bitcoin and the Rise of Fungible Tokens

Bitcoin, the first decentralised digital currency, has sparked a revolution in financial technology since its inception in 2009. This cryptocurrency operates on a peer-to-peer network, underpinned by blockchain technology—a ledger of all transactions updated and held by currency holders.

As Bitcoin's utility and acceptance have grown, so has the complexity and variety of applications built on its blockchain. Among these developments are fungible tokens, which represent equal value and are interchangeable, similar to traditional currency but operating on the blockchain. These tokens have traditionally been limited by the capabilities and design of the blockchain they reside on.

The introduction of the Lightning Network was a major step forward in Bitcoin’s capabilities. Enabled by the SegWit (Segregated Witness) upgrade, which improved scalability by optimising data storage in blocks, the Lightning Network acts as a second layer solution to facilitate instant, near-zero fee transactions.

This development, alongside the Taproot upgrade—which aimed to integrate layer 2 functions such as smart contracts more efficiently—represents foundational steps in enhancing Bitcoin's functionality, showcasing the blockchain's potential beyond just serving as a digital currency.

In recent years, the Bitcoin network has seen several initiatives to introduce fungible tokens directly into its ecosystem, with varying degrees of success and functionality.

The most notable development before now has been the BRC-20 token standard created by the pseudonymous developer Domo in March of 2023. While innovative, BRC-20 faced challenges, such as inefficient use of space and slow adoption rates, which hampered its potential.

Fungible Tokens in Bitcoin

Fungible tokens are tokens that are not unique, they can be divided, and they are interchangeable. Not only that, but they also exist on other blockchains such as SPL on Solana and ERC20s on EVM chains.

Compare this to non-fungible tokens (NFTs) which are digital assets that are unique and cannot be interchanged on a one-to-one basis with other tokens. Each NFT has distinct characteristics and metadata that set it apart from others, making it irreplaceable and indivisible.

We can see a stark difference between fungible tokens and non-fungible tokens!

Historically, the Bitcoin Network has not supported smart contracts, meaning that fungible tokens were not possible on Bitcoin. That all changed with ordinals. The introduction of ordinals led to the emergence of BRC-20s, which embed token data within individual satoshis (SATs) and rely on off-chain indexers for processing.

Even though BRC-20 tokens brought a form of fungible tokens to Bitcoin, the method was also accompanied by multiple downsides such as excessive UTXO creation, multiple TXNs having to be used for minting, transferring, and claiming, and the ability to only transfer one token at a time.

What is Bitcoin's UTXO model?

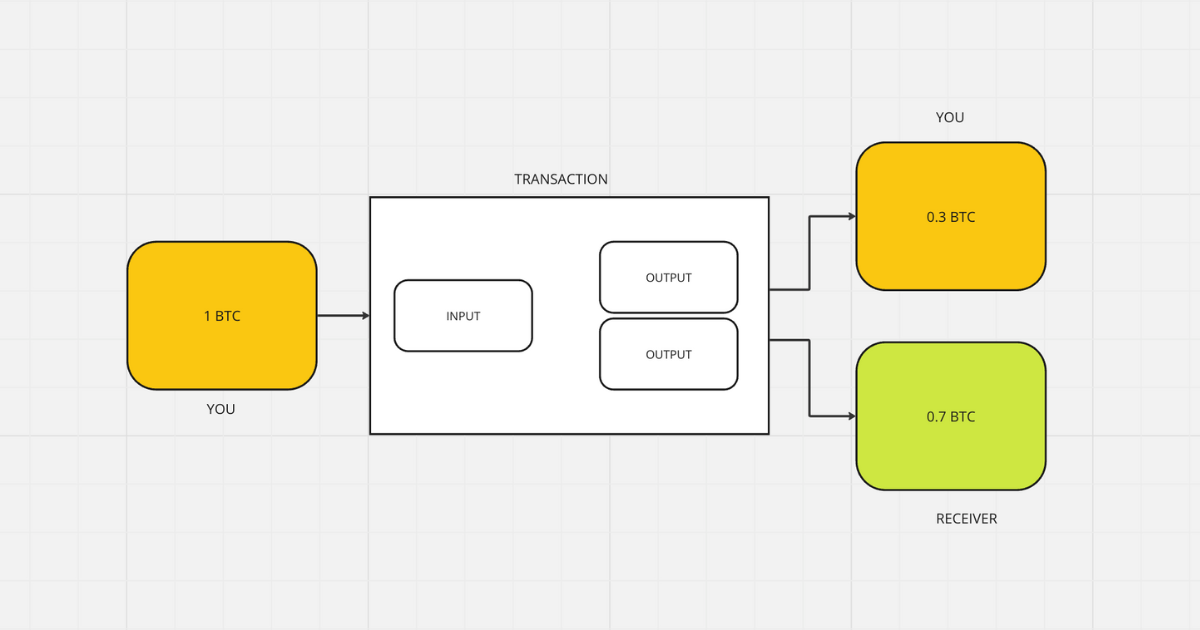

In Bitcoin transactions, an unspent transaction output, or UTXO, represents the amount of digital currency available for someone to spend. Every Bitcoin transaction creates outputs, recorded as potential new inputs for future transactions.

These outputs that haven't been used in new transactions are called UTXOs. The Bitcoin network keeps track of all UTXOs, ensuring each transaction is verified and the list updated. This prevents any Bitcoin from being spent more than once, which is crucial for the security and integrity of the Bitcoin blockchain.

To put it simply, when a transaction takes place, the input is deleted and an output is generated. A UTXO is the output left over and can be used in other transactions. UTXOs are essentially the coins left over in the same wallet after a transaction is complete.

See the image below for more context:

Introducing Bitcoin Runes

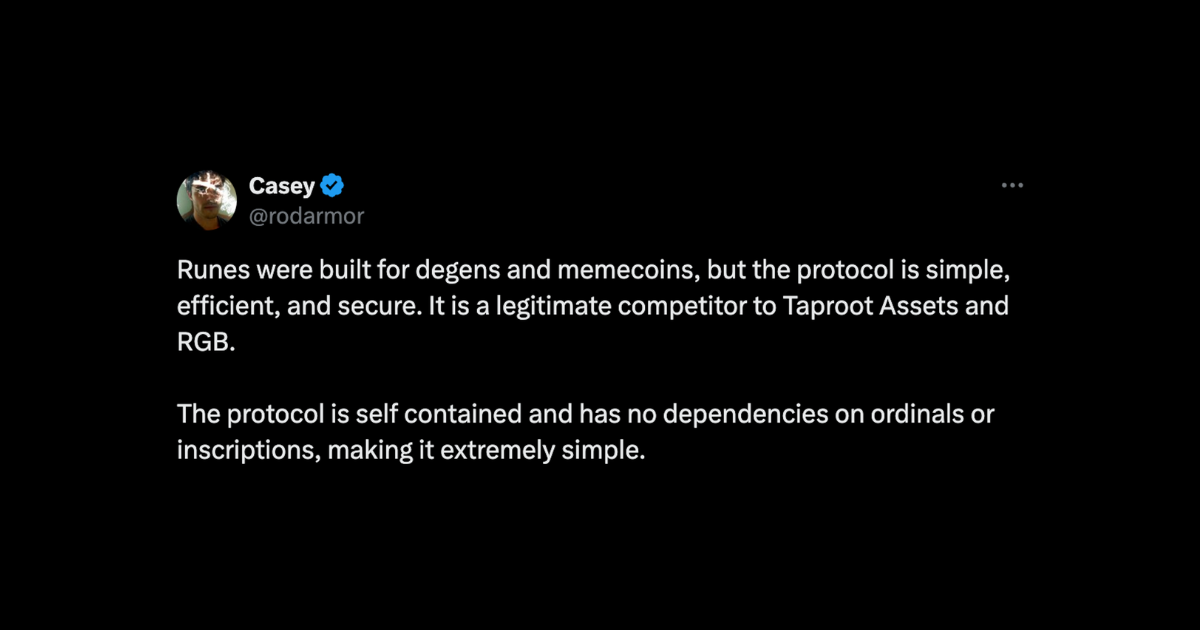

This brings us to Bitcoin Runes, a new fungible token protocol designed specifically for the Bitcoin blockchain that ordinals creator Casey Rodamor proposed in September of 2023 which will bring a new kind of fungible tokens to Bitcoin at the next Bitcoin halving.

The Runes protocol is a minimal protocol to support fungible tokens (meme tokens) and doesn't require a change to Bitcoin.

Runes aims to address the shortcomings of systems like the Bitcoin ordinals protocol, by offering a more efficient, secure, and user-friendly way to create and manage tokens directly on Bitcoin.

Understanding the Runes Protocol

By addressing the inefficiencies and limitations of previous standards, the Runes protocol offers a streamlined and optimised approach to token creation and management.

This protocol allows for the issuing and the transfer of Runes tokens directly on the Bitcoin blockchain, using a model that enhances security and scalability.

Let's unpack this new fungible token standard in more detail below:

The problem that Runes solve

To understand how the Runes protocol adds value to the Bitcoin network, we first need to understand the problems it overcomes.

It's important to remember that Runes are fungible tokens issued directly on the Bitcoin network. Secondly, it's important to understand how Runes solves problems and creates efficiency on the network in comparison to existing protocols.

BRC-20 tokens, although a novel innovation at the time that at first garnered a lot of developer interest by allowing for the creation of Bitcoin native fungible tokens for the very first time, created an extremely high volume of what is known as "junk" UTXOs. These excessive UTXOs began to overload the Bitcoin node making them more expensive to run.

One of the standout features of the Runes protocol is its use of the unspent transaction outputs (UTXO) model, which is fundamental to Bitcoin's architecture. The Runes protocol does not require off-chain data or a native token to operate which is in stark contrast to some existing protocols like how the Taproot Assets Protocol stores asset metadata off-chain.

Ensuring more responsible UTXO management ensures that Rune tokens integrate seamlessly into the existing framework of the Bitcoin network, maintaining compatibility and enhancing performance, and is a key feature of how the Runes protocol works.

How the Runes Token Standard Works

Now that we've understood the basics of the Runes protocol, let's understand how exactly it works.

Issuing and Transferring Tokens

Creating fungible tokens through the Runes protocol begins with a transaction known as an issuance transaction which defines the token's characteristics, such as its symbol, total supply, and decimal numbers.

This token supply is then given a UTXO which allows a single UTXO to contain any amount of Runes, this could be billions, millions, or less. These UTXOs are then used to track Rune balances.

A transfer function splits a UTXO into multiple new UTXOs, each holding different amounts of Runes, to distribute the records to recipients.

The management of Runes tokens is facilitated by the protocol's robust system for tracking and verifying transactions. As mentioned above each Rune token is associated with a unique numeric identifier, which ensures its authenticity and traceability within the Bitcoin ecosystem.

Storing of Data

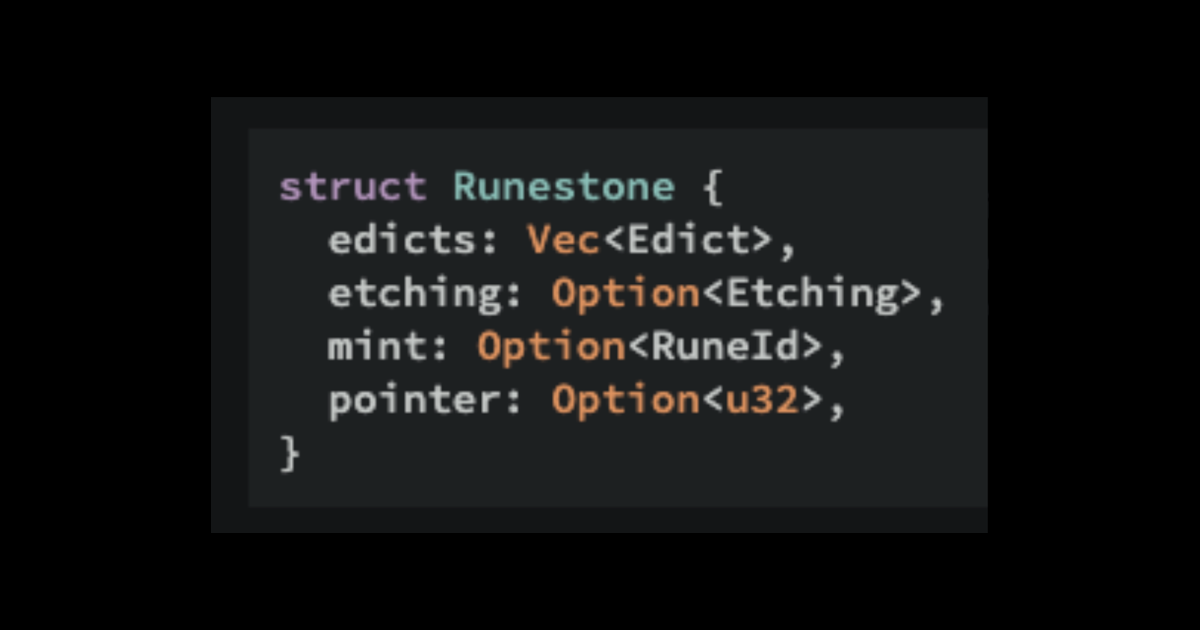

The Runes protocol utilizes a unique component called "runestones" to manage and communicate information about token actions within the Bitcoin blockchain.

Runestones are essentially messages embedded within the OP_RETURN section of a Bitcoin transaction, and they play a crucial role in the protocol by detailing the actions being taken—whether tokens are being created (etched), distributed (minted), or moved (transferred).

Unlike the Ordinals protocol, which stores data in the larger, less efficient witness section of a transaction introduced by the SegWit upgrade, Runes optimizes storage by using the OP_RETURN field. This field is limited to 80 bytes encouraging more efficient use.

In the case of both Runes and ordinals, the actual data about the tokens is not stored within the unspent transaction outputs (UTXOs) themselves. Instead, off-chain indexers associate each UTXO with the correct data, effectively tracking the movements and balances of tokens outside the blockchain’s more restricted data fields.

Process of Transacting with Runes

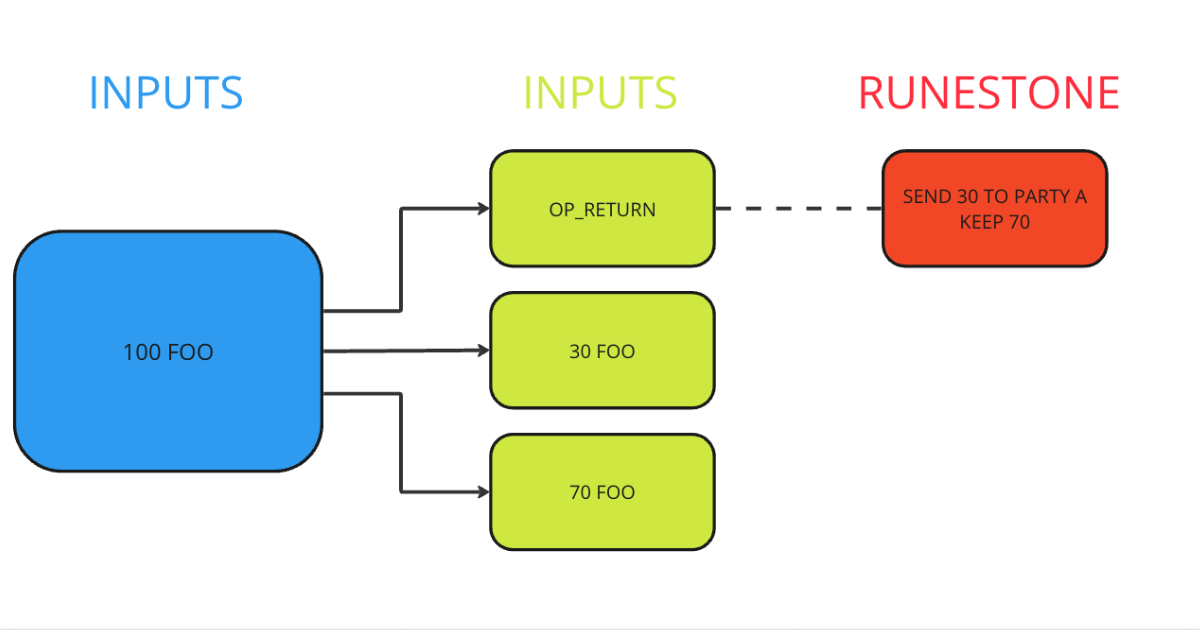

For example, in a typical transaction scenario between two parties—let's say Party A and Party B—Party A would initiate a transaction by declaring a runestone indicating their intent to send 70 runes to Party B.

The transaction would involve an input UTXO from Party A’s wallet containing 100 runes, and it would result in two output UTXOs: one with 30 runes returning to Party A, and another with 70 runes allocated to Party B.

This method of using runestones and associating multiple token balances with a single UTXO drastically improves efficiency over other fungible token protocols like BRC-20, which only allow a single token type per transaction.

By enabling multiple rune balances per UTXO, the Runes protocol significantly reduces the number of UTXOs that need to be managed and tracked on the network. This reduction not only speeds up processing times but also lowers the costs associated with running a Bitcoin node, making the overall network more efficient and less expensive to maintain.

The Future of Bitcoin with Runes Protocol

As we have explored, the introduction of the Runes protocol represents a significant advancement for Bitcoin, offering a fresh perspective on fungible tokens within its ecosystem. This new protocol alleviates the challenges associated with previous token standards like BRC-20, particularly those relating to inefficiency and high transaction fees.

By leveraging a minimalistic approach that integrates seamlessly into Bitcoin's existing framework, Runes not only simplifies the creation and management of tokens but also enhances the overall scalability and efficiency of the network.

By optimizing the use of UTXOs to store and manage rune balances, Runes enables a more efficient transaction process, which is particularly advantageous as Bitcoin continues to grow and attract more users.

Looking ahead, the implementation of Runes at the upcoming Bitcoin halving presents an opportune moment for the protocol to demonstrate its value. As the network undergoes its halving event, reducing miner rewards and potentially increasing transaction fees, the efficiency and low-cost transaction model offered by Runes could become increasingly vital.

The new Rune protocol not only promises to support the current needs of the Bitcoin community but also paves the way for new applications and innovations within the blockchain.

In summary, the Runes protocol is set to play a crucial role in the evolution of Bitcoin. It addresses key technological challenges while opening up new opportunities for users and developers alike.

As the Bitcoin community continues to expand and evolve, Runes provides a promising foundation for future growth, ensuring that Bitcoin remains at the forefront of digital currency innovation.

How Pangea fits in

The introduction of protocols like Runes and Ordinals on the Bitcoin blockchain highlights a critical need for robust, trustless data infrastructure. Pangea addresses this need by delivering verifiable and flexible blockchain data essential for managing and verifying these protocols.

Unlike traditional data services that rely on centralised systems, Pangea ensures that all data—from token transactions to smart contract interactions—is transparent and directly traceable back to its source, providing a decentralised solution that enhances security and trust.

If you're looking for this kind of solution, get in touch with us via the links below: